Risk Mitigation for Factoring

Safeguard Your Lending with XEN

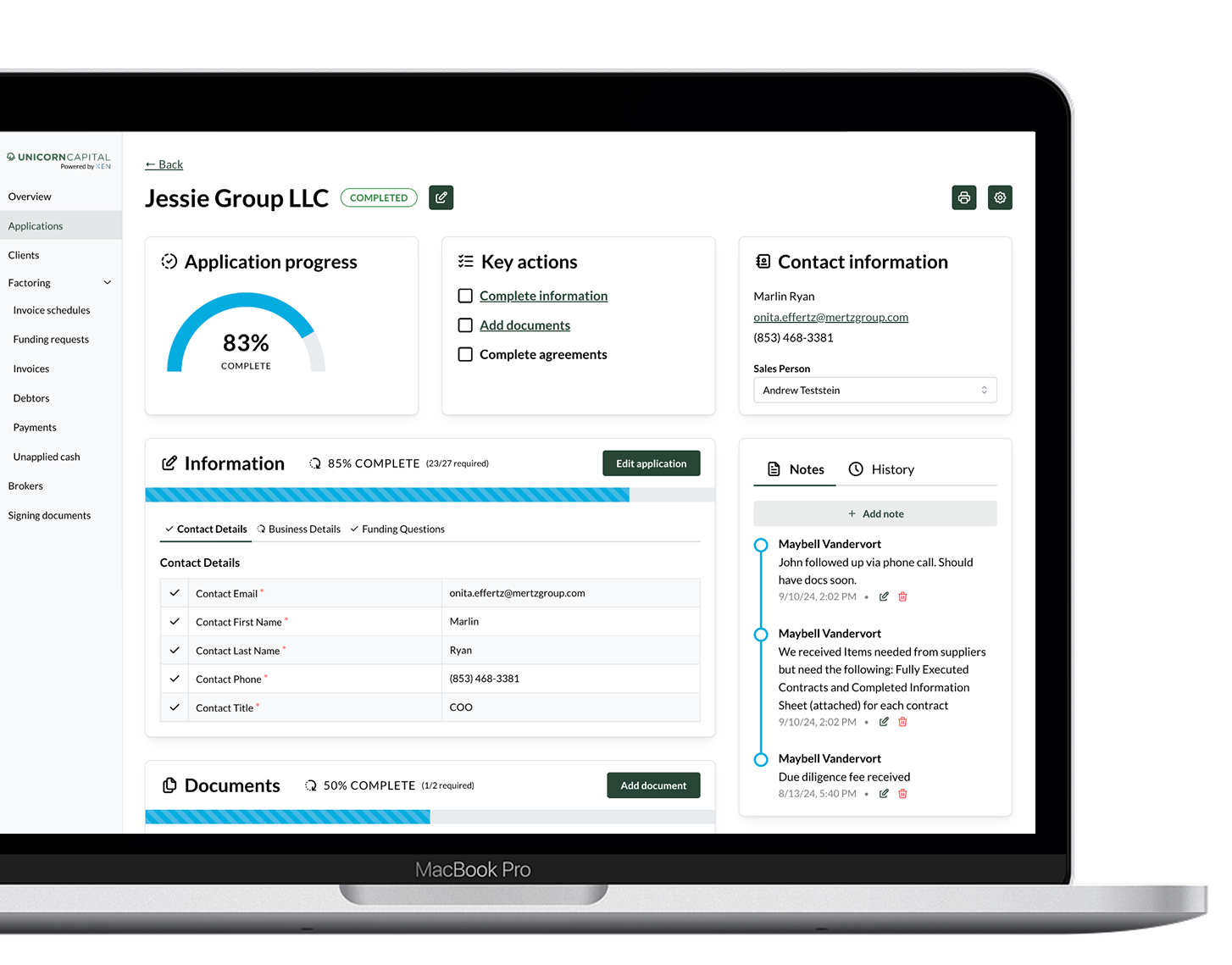

Key Features of XEN's Risk Mitigation Platform

Fraud detection: Uncover ID and document fraud to protect your business from potential losses.

Application metadata analysis: Identify suspicious activity, such as VPN usage and IP address discrepancies, to assess risk.

Centralized background checks: Conduct UCC, lien, bankruptcy, and criminal background searches in one convenient platform.

Comprehensive lending solution: Enjoy the full range of XEN's features, including customizable solutions and dedicated support.

Integration Partners include:

Benefits of XEN's Risk Mitigation Solution for Your Lending Business

Minimize risk exposure

Proactively detect and address potential risks to protect your bottom line.

Enhance decision-making

Make informed choices with a comprehensive view of applicant backgrounds and application data.

Improve operational efficiency

Streamline risk assessment processes and reduce manual effort with automated tools.

Foster client trust

Demonstrate your commitment to security and responsible lending practices.

Request a demo

Explore our platform's capabilities and discuss how we can tailor our solutions to meet your business needs.

…or try it yourself

Our team will ensure a smooth transition, getting you up and running quickly.